And if it was time to renovate the tourist tax?

And if it was time to renovate the tourist tax?

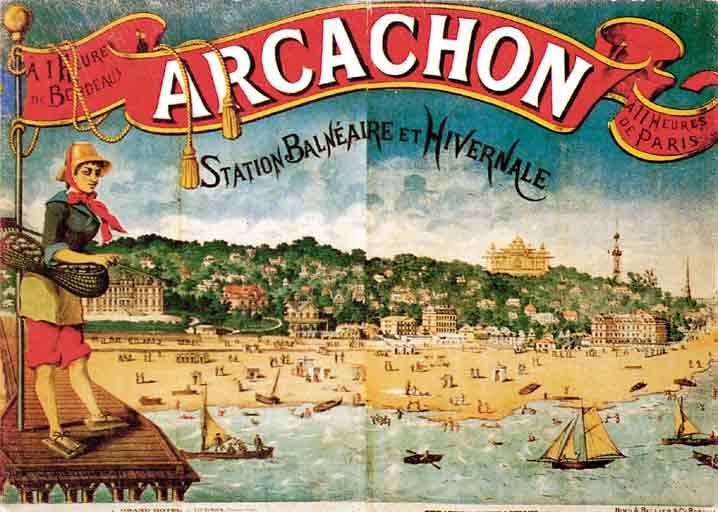

Created by a law of 1910, the tourist tax is instituted on the initiative of the municipalities realizing expenses favoring the reception of tourists. Originally, it could only be instituted by classified tourist resorts. This possibility has been extended over the years, to mountain towns in 1985, a year later to coastal towns, in 1988 to towns carrying out tourism promotion actions and, finally, to towns carrying out protection and management of their natural areas in 1995. It has become instituted by public establishments for inter-municipal cooperation (EPCI) which comply with the conditions applicable to municipalities from 1999. Source Ministry of Finance

ORIGINALLY

Created in France in 1910, the tourist tax was intended to finance the territorial action of seaside resorts to compete with their counterparts in Germany and Austria who already collected a « Kur Tax » dedicated to their development. (1). It stems from a bathing tax that already existed in Germany from the 16th century and the text voted in France indicates the passage of a collector at least every five days at the accommodation providers, the collection of the tax in view of the register of the landlord.

And yet this tax will not be viewed favorably since in 1019, only 68 municipalities out of a possible 240 adopted it. It will take the development of the coast and winter sports to see this tax, which is very important for the tourist industry, become widespread.

A COMPLICATED TAX TO COLLECT

Over time and some modernizations mainly affecting categories and amounts, the tourist tax is becoming widespread in France. Finally …. generalizes is a very big word since a certain number of municipalities have not yet passed the course but nevertheless have beds on their territory. Whether they are professionals in the hotel industry or private renters who find it fun to develop additional income by operating a family home or an apartment in a second home, all these goods are subject to a tourist tax.

COLLECTION

The problem arises in its collection. In more than 100 years, the collector has disappeared, knowledge of the economic fabric of accommodation with. Because if we know the professionals in the sector, do we really know their instantaneous capacity? Are all private lessors known to their reference administration?

The problem in all this is to have gone from a collector to not much, sorry to a declaration on good will…

ITS PRIMARY GOAL

Without going back on its usefulness and all that it can bring as a benefit to its citizens in return for a sometimes excessive tourist activity, the first goal was to increase the investments of the territories in order to remain competitive vis-a-vis the other destinations. Without a reliable and organized perception, this financial capacity dwindles and we don’t talk about collection techniques, because there are tools that do the job very well.

The concern is not the brokers, Booking, Airbnb either, their job is to rent, not to deal with local taxes. It would be like asking Accor to manage tourist taxes at the national or international level, this is not the initial deal. The local stays local, each hotel collects and donates to its reference public establishment. The same must be true for all the rental leisure segments of the territories.

FORMAL REFORMS

Unfortunately, the latest reforms have not been in this direction and have focused on the amount, age and competence of collection without really tackling the financial leakage that exists and the means to be put in place to make it a advantage for the territories.

AND IN OTHER COUNTRIES?

In other countries, it is sometimes better, sometimes worse. Germany, Switzerland, Italy and Austria follow the same model as France and there are regional disparities. On the other hand, some countries require police declarations per night and this allows a better measure for professionals. The amount collected is affected!

There is therefore room for maneuver to continue to develop the system, but no ready-made solution.

Others are less well off, Spain does not collect a tourist tax everywhere, Portugal has applied single nightly rates since 2016. Tunisia has chosen the global package of 13 € for its visitors. There is something for every taste.

And if it was time to renovate the tourist tax?

The Alps agency accompanies throughout the year a good number of territories in their strategies or their reflections that make the difference. Do you want to know our references? Contact us

You wish to organize a conference on this theme, contact us too, we will analyze your needs together.

You can read all the other articles of the Alps Agency in the Blog section and discover all the services we can offer you.

This article was written by François Veauleger